385 words, 2 minutes read time.

Now that I’m 40, I’ve done some reflecting. In all, I don’t have too many complaints when I really think about it. I mean, America’s golden age – at least in recent history and the era we still seem to consider the gold standard (hehe) – was the 1950s and 60s, and a time in which the war and postwar generations saw large economic growth.

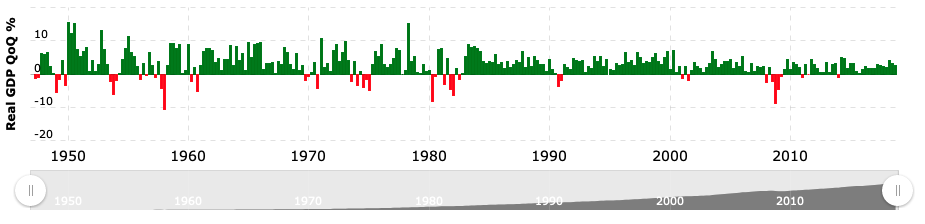

Just look at those GDP spikes, compared to 2007, when I entered the workforce full time! Sure there were some recessions, and the Boomers still whine about how bad interest rates were in 1980 (and how so many of them were almost drafted for The Vietnam War), but look at the growth recovery following each of those events, compared to the 2008 Great Recession.

Recession of 1953

Inflation and rising interest rates:

Early 1980s recession in the United States

Inflation and oil energy dependency:

https://en.wikipedia.org/wiki/Early_1980s_recession_in_the_United_States

2007–2008 financial crisis

Unsustainable and predatory financial lending practices:

https://en.wikipedia.org/wiki/2007%E2%80%932008_financial_crisis

And studies which I won’t bother to cite because you have a search engine too have long mockingly laughed at my generation’s plight, as those who enter the workforce in a recession are doomed to never make much money. And yet, here Liz and I sit, apparently as 12%-ers. And also apparently I’ll be a multi-millionaire at retirement according to projections. And like most of my generation, I normally don’t discuss my financial situation, because we just don’t want to get into it with a boomer. But sometimes I think it’s healthy to brag about one’s accomplishments and this one in particular is contrary to everything I was told was going to happen, thanks to boomer generational masturbatory article headlines (“Your kids are lazy and won’t get a job and they’re moving back home to take your money”).

But I started off on a tangent. I meant to post some cheap laughs at becoming older, but I’m apparently so adversarialy positive about my situation that I got distracted with everything good that’s happened on my journey to becoming middle-aged.

Oh well. Fodder for my next post I suppose, since I’m almost hitting 400 words here! Next time – how long it takes to grow out a damaged fingernail! Woo!

–Simon